The global gluten free product market – estimated at $4.3bn in 2021 – is projected to reach $6.2bn by 2030, giving a CAGR of 7.7% according to Spherical Insights. Such metrics are hardly surprising, given changing lifestyles and – more specifically – the increasing global prevalence of coeliac disease (where the immune system literally attacks the individual’s own tissues when gluten is consumed), which affects an estimated 1.4% of the population. It’s a figure that’s likely to increase as improvements in diagnostic technologies and general medical science enable strategies for more accurate disease diagnosis. As a result, demand for gluten-free foods increases too.

Low bar

The definition of ‘Free-From’, however, is a broad one and can include many food products/ supplements, so long as they’re characterised by the absence of a component, be it lactose, gluten or other allergens. While cynics charge that this is a low bar, what has been evident in recent years – both pre and post-Covid-19 – has been a shift in market dynamics.

Prior to the Covid-19 pandemic, the number of working women had already been increasing; and with it, a growing reliance on gluten-free ready meals and convenience foods. In response there was a significant increase in the number large retail formats globally – including convenience and speciality stores – offering gluten-free products in anticipation of this market continuing to grow. And since the emergence of Covid, there have been further changes.

As Bradley Grimshaw, managing director, Dr Schär (UK) explains: “Consumers have been consuming more at home and cooking their own food and engaging with nutrition. The pandemic has brought many things to light and made us aware of the importance of healthy eating habits.”

Dr. Schär, for its part, continued to invest during the pandemic – a prime example being its acquisition of the Glasgow based allergen-free, fresh bread manufacturer, GDR Food Technology Ltd (GDR), which represents Dr. Schär’s first UK production plant.

Meet the gluten challenge

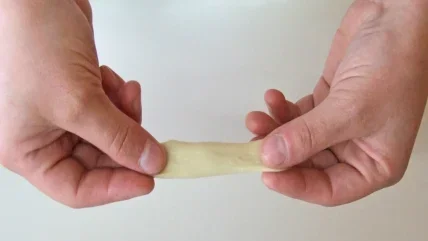

On the face of it, the acquisition of GDR Food Technology was a logical one, given the importance of bread as part of an individual’s everyday diet. The challenge, though, has been that while the gluten protein can be found in wheat, barley, rye and triticale, among other cereals, its primary function is to provide elasticity to the dough, which is then used to create a line of products by giving a chewy texture and maintaining the product’s shape. That is easier said than done.

To achieve optimum taste and texture requires the testing of different types of flours, modifying existing mixing and processing methods and finally, ensuring shelf life isn’t compromised. Moreover, gluten has a naturally high level of water hydration, for example, meaning that any corresponding difference in texture will likely impact the temperatures at which rolls and bread are sliced. Also needing to be factored into this equation is longevity and freshness of the product – an obvious solution being the need to find a water-soluble extract from a grain that also happens to be gluten-free.

Grimshaw maintains an air of confidence though, arguing that combining the company’s expertise in food technology and nutrition, coupled with its understanding of the needs and wishes of its consumers, allows for it to “consistently develop food products for a nutritionally balanced diet and continually strive to improve its processes and management systems”.

Preventing contamination

It’s also a question of maintaining quality checks, given the issue of contamination is crucial when it comes to making a product gluten-free. That’s why GF products must be packaged in a way that protects them more than conventional products, according to Grimshaw.

He adds: “Our quality assurance teams support our production teams in standardising processes. They monitor and control hazards to safeguard the quality of the raw materials, as well as of the end products. (And) that means no artificial flavourings, aromas or colourings, are added. Nor artificial preservatives.”

“Together with our suppliers and processors, they ensure that we deliver only the best and safest product to the consumer. Using the VITAL concept (Voluntary, Incidental, Trace Allergen Labelling) an international team of over 40 trained Dr. Schär employees guarantee production quality and safety, from the raw materials to the finished product,” Grimshaw further notes.

Develop the right technologies

For Dr Schär, ensuring food safety means not only developing the right production technologies in cooperation with suppliers, but also employing highly specialised technologies for the entire process and investing in them every year to keep them up to date.

The dairy industry, meanwhile, faces similar manufacturing challenges – most obviously the need for food companies to ensure their products not only don’t inadvertently contain allergenic ingredients, but also are correctly labelled – usually by documenting their policies on allergen management, as well as developing and complying with an AMP within their food safety programmes.

AMP (Advanced Microbial Profiling) is a DNA technique used to determine the unique mix of the micro-organisms (microbiome) in food samples, without the need to culture them in a lab.

“The pandemic has brought many things to light and made us aware of the importance of healthy eating habits.”

Bradley Grimshaw

$4.3bn

The estimated value of the global gluten free product market in 2021 – it is projected to reach $6.2bn by 2030.

Spherical Insights

As the Global Food Safety Resource Centre has described it: “When compared to traditional culturing, AMP offers a different way to investigate the microflora in a food product. By showing ‘everything that is there’ – not just those microbes that can be cultured – it can provide us with insights that were previously unavailable from data that was formerly unobtainable.”

For example, the unintentional presence of allergens in a product may sometimes occur – usually the result of issues such as management failures, including mismanagement of raw ingredients, accidental misformulation of a product, or incorrect/ incomplete labelling. Similarly, there may be cross-contact – including during the manufacturing process – due to equipment design, poor cleaning, the result of airborne particles during rework, or simply through operator error.

Irrespective of what potentially could go wrong in the factory, governments have slowly been catching-up – from a legislative standpoint – when it comes to the promotion of free-from products, as well as protecting consumers from allergens where potentially serious issues may arise.

The impact of Natasha

Case in point is the UK, where ‘Natasha’s Law’ came into effect in October 2021. Essentially it tightened up the existing regulatory regime by requiring food businesses to provide full ingredient lists and allergen labelling on foods pre-packaged for direct sale on the premises. The law is named after 15-year-old Natasha Ednan-Laperouse who passed away following a severe sesame seed allergic reaction, having not been made aware at the time that sesame seeds had been baked into the bread of a sandwich she’d just purchased.

In addition to Natasha’s Law new HFSS (high in fat, salt and sugar) regulations came into effect in the UK on 1 October 2022. These restrict the display and in-store promotional locations of foods high in fat, salt and sugar. At Kraft Heinz meanwhile, much of the company’s diverse portfolio of ketchups, soups and sauces are inherently dairy and gluten free, as Miriam Ueberall, VP of R&D for Kraft Heinz International, is quick to point out.

But she adds: “We are currently developing a vegan tomato soup where dairy ingredients are replaced with soy ingredients and have invested in our manufacturing capabilities, since the process of dealing with dairy ingredients is different than that of dealing with soy.

“Processes differ slightly based on the product being developed. At KHC we are ‘consumer obsessed’ and always start by listening to our consumers. We employ social listening strategies and engage in regular dialogue with our consumers to better understand their needs.”

Based on this information, prototypes are developed and tested with consumers and, after feedback, needed changes are made to them to meet their expectations.

“We then make the product in our pilot plant before manufacturing it on an industrial scale,” says Ueberall. This forms part of Kraft Heinz’s strategy to be more agile at scale. Indeed, such agility can already be seen with the roll-out of a range of gluten-free products in Italy under the ‘BiaGlut’ brand as Ueberall notes.

Field of reality, not dreams

Yet implementation of a free-from approach isn’t simply a just question of removing ingredients. Indeed, there are wider biodiversity implications too – best exemplified by Dr Schär’s Field100 Project, for example, where 100 different crops are being grown in a single field in the South Tyrolean Alps.

As Dr Schär’s Bradley Grimshaw puts it: “Biodiversity is crucial not just for global food security, but also for our ability to serve diverse nutritional needs and responding to the increasing challenges posed by climate change. Today, 40% of all plant species are threatened with extinction.”

Indeed, biodiversity loss is a very real issue and especially critical when it comes to agriculture. According to the FAO (Food and Agriculture Organization of the United Nations), for example, just nine food crop species currently account for as much as 66% of total crop production.

Such a dependence on a few plant species and the lack of genetic variation in farmers’ fields make the food system vulnerable, according to Grimshaw.

As for the Field100 project itself, local oats and buckwheat have been grown together in harmony with Nepalese amaranth or quinoa from the Andes – right ‘on our doorstep’, according to Grimshaw.

He adds: “At the end of the project, we donated the harvested seeds to the gene bank of the Laimburg Research Centre to ‘refresh’ their inventory and preserve them for the future. Field100 is our commitment to championing biodiversity.”

From a macroeconomic standpoint, however, the free-from industry – heavily reliant (as it invariably is) upon the supply of raw materials such as grains – will continue to be negatively impacted by frayed global supply chains; leading to increased production and distribution costs. If this continues, the question then becomes whether increased prices will meet resistance from those consumers merely looking for lifestyle changes as opposed to those where allergen-free literally is a matter of life and death. The jury is still out.

The hidden benefits of natural astaxanthin

A naturally occurring dark red carotenoid, astaxanthin is primarily found in aquatic animals such as salmon, trout, krill, shrimp, crayfish, crustaceans and microalgae. One of the most powerful lipophilic antioxidants discovered, it has been shown to be 500 times stronger than vitamin E and stronger than other carotenoids such as lutein, lycopene and beta-carotene. Numerous studies have established that the use of natural astaxanthin can reduce the risk of certain chronic diseases, improve cardiovascular health, better muscle strength and joint pain and has been shown to have anti-inflammatory and immune-stimulating effects, as well as promote healthy skin.